R&D Tax Relief

Driving Innovation

Supporting Innovation and Business Growth

Since 2000, the government has supported businesses investing in innovation through Research & Development (R&D) tax relief. This forward-looking tax incentive encourages investment in activities that can potentially lead to future improvements. R&D tax relief can significantly impact your business growth, providing financial support to turn ideas into commercial success.

The R&D tax relief scheme aims to enhance the UK’s competitive advantage by applying new or improved knowledge and capabilities in science and technology to commercial endeavours. The focus is on funding projects that seek growth in scientific or technological know-how rather than commercial outcomes. Projects can qualify for tax relief even if they fail, as success is not a requirement.

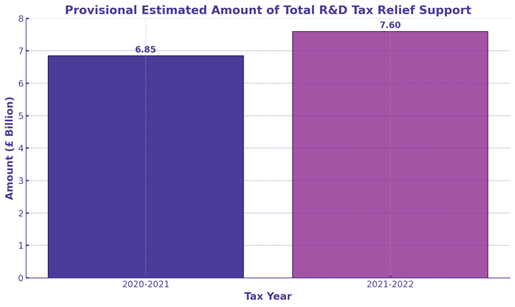

According to HMRC there was an estimated 11% increase in R&D relief in the tax year 2021-22 in comparison to the previous tax year.

Our Expertise

How R&D Tax Relief Supports Your Work

InnoFund’s team of PhD’s, IP specialists and innovation enthusiasts can help you reinvest funds to further innovate or develop projects in a tax efficient way.

InnoFund understands all stages of the IP and R&D lifecycle, clients that partner with InnoFund get the added value of being able identify, crystalise and exploit their IP with benefits that go beyond a normal R&D Tax advisor relationship.

Cash received from R&D can be reinvested into:

-

Further development projects

-

Hiring more staff

-

Training

-

Capital Equipment

-

Expanding your premises

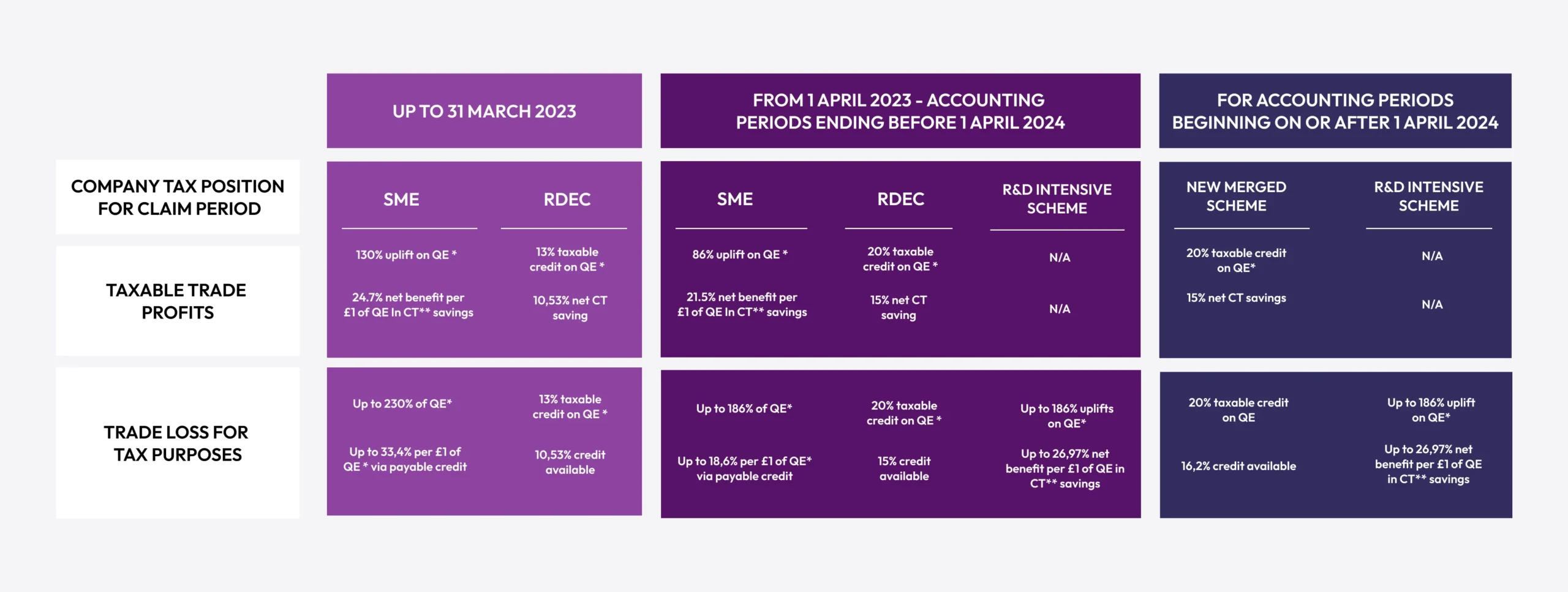

Comparison Table

R&D TAX RELIEF RATES

Our Expertise

We identify commonly overlooked opportunities

R&D Tax Credits

HMRC dispute resolution & Tax compliance

IP Search & Patent Box

Property Taxes benefits.

Our Expertise

Compliance & Dispute Resolution

-

Supervised by ICAEW for AML purposes

-

PII inline with ICAEW regulations

-

Bound by ICAEW Code of Ethics

-

Work to Professional conduct in relation to taxation (PCRT)

-

Accredited mediator (CEDR) for Tax disputes

Testimonials

Listen to some clients that partner with us

InnoFund’s insight into the market has been valuable in serving our clients across all sectors. Not only do they understand the nuances within R&D Tax Credits but they are great at spotting other funding opportunities for our clients. Their smaller team is much more personable than some of the large corporates we’ve partnered with and they really do go that extra mile to satisfy our customers. I wouldn’t hesitate to refer their services to anyone in my network

Adam was referred by one of our sub-contractors and came highly recommended. We previously did an R&D Tax claim with our accountant so we weren’t new to the process. InnoFund were quick to highlight other activities and opportunities our accountant overlooked, specifically new projects and cost centres we thought were outside the scope of R&D. Simply put they changed our understanding of what R&D is. Additionally they were able to submit claims for three other companies in the group. The result was a net benefit of 8x that of our previous one. This helped massively after Covid-19 and R&D Relief is now a priority business strategy. InnoFund continues to add value by streamlining future claims through a real-time R&D capture process.