Capital Allowances 101

Capital Allowances are a form of tax relief available to UK taxpayers when they invest in certain types of capital expenditure.

Who is eligible for capital allowances?

Property occupiers and investors can access capital allowances.

If you are thinking about purchasing or selling a commercial building or investing in improving an existing commercial property through a refurbishment or fit-out and you are an income or corporate taxpaying entity tan it is a highly likely that you can benefit from capital allowances. We can help with:

- Purchase price allocation: Identifying qualifying plant and machinery within commercial property acquisitions.

- Refurbishment and fit-out claims: Capturing relief on upgrades to integral features and fixtures.

- Land remediation relief synergy: Identifying where contaminated land and capital allowances overlap to deliver dual tax benefits.

You can see examples of our work here.

How Do Capital Allowances Work?

Capital allowances are not applied automatically and must be actively claimed through your tax return. There is no set deadline for making a claim, unlike other tax incentives Capital Allowances are not time-barred, provided the asset in question is still owned and in use by the business.

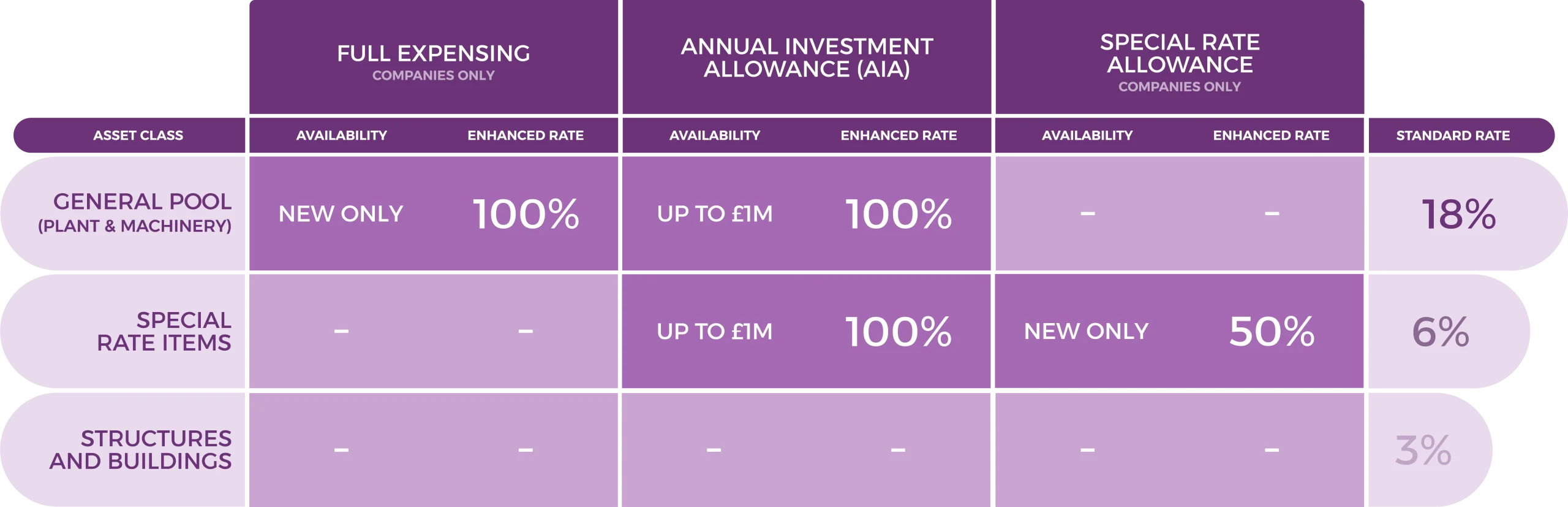

When purchasing a property or planning a refurbishment, it’s crucial to assess the available rates and allowances to help optimise your tax position and reduce the overall cost of the project, there are three different types of asset class Plant & Machinery, Special Rate Items and Structures and Buildings with different rates as outlined in the graph.

Estimating Allowances

| New Construction | Property Acquisition | Refurbishment | Fit Out |

|---|---|---|---|

| Between 10% – 50% of expenditure may qualify | Up to 30% of the sale price may qualify | Between 25-50% of the expenditure may qualify | Up to 80% of the expenditure may qualify |

Recent Developments and Legislation

The Spring Budget 2023 introduced:

The permanent AIA threshold of £1 million, providing certainty for businesses.

The new Full Expensing measure for companies investing in qualifying plant and machinery.

Continued support for First-Year Allowances for green and energy-efficient equipment.

InnoFund ensures you stay up-to-date with evolving legislation to take full advantage of all available reliefs.

What Expenditure Qualifies?

Capital Allowances can be claimed on a wide range of assets, including:

Fixtures and fittings (e.g., lighting, heating systems)

Plant and machinery (e.g., manufacturing equipment, lifts, air conditioning)

Integral features (e.g., electrical systems, water systems)

Vehicles (excluding cars in most cases)

Renovations of commercial buildings

Freehold and leasehold property acquisitions (via embedded fixtures)

Each business will have unique qualifying assets depending on its sector and type of expenditure. InnoFund’s dual surveying and tax expertise ensures no opportunity is missed, especially for embedded or overlooked items.

Frequently asked questions

What if I already have an accountant?

Whilst your accountant will have a good understanding of capital allowances they are unlikely to also be a chartered surveyor or valuer. Until you have had a room by room survey for the purposes of a capital allowance claim you can not be confident your accountant has claimed all you are entitled to. Examples of why items are overlooked:

Expenditure on property refurbishments or alterations is often poorly documented. Invoices frequently refer to generic stage payments or high-level contractor services without a detailed breakdown. This lack of itemisation makes it difficult for accountants to identify which costs could qualify for capital allowances.

When purchasing a property, only moveable assets (chattels) tend to be included, but detailed information about fixed assets such as integral features and plant & machinery is often missing. As a result, many qualifying items are overlooked. The old approach of applying a blanket percentage of the property price is no longer acceptable under current rules.

The rules governing what can and cannot be claimed on property-related assets have become increasingly complex, covering a broad range of equipment and installations. Due to this complexity, and the risk of making incorrect claims, many opt to leave potentially eligible items unclaimed.

Timing is another factor – claims are sometimes overlooked if property purchases or fit-outs were completed several years prior and are no longer top of mind. Without a full review of the property’s history (including prior owners’ claims), accountants may assume capital allowances have already been fully utilised, when in fact unclaimed allowances could still be available.

What is capital expenditure?

Tax law distinguishes between two types of expenses:

Revenue Expenditure: These are routine costs necessary for the daily operation of a business, such as heating, lighting, employee salaries, and office supplies. These costs are immediately deducted from business profits when calculating taxable income.

Capital Expenditure: These are investments in assets that provide long-term benefits, typically over several years, such as purchasing buildings, vehicles, machinery, or computers. Unlike revenue expenditure, capital expenditure cannot be deducted directly from taxable profits. However, tax relief may be available through capital allowances. It’s important to note that not all capital expenditures qualify for these allowances—for example, the cost of purchasing land typically does not qualify.

While revenue expenditures provide immediate tax relief, capital expenditures require a different approach for tax deduction

What types of capital allowances are there?

- Know-how Allowances: A relief available only for income tax (not corporation tax), for traders who incur qualifying expenditure on acquiring “know-how” (e.g., knowledge of industrial techniques or information).

- Patent Allowances: Another relief for income tax only, applicable to traders who incur qualifying expenditure on acquiring “patent rights” (i.e., the right to perform actions that would otherwise infringe on a patent).

- Mineral Extraction Allowances: Primarily for companies in the oil industry, but also applicable to businesses involved in extracting minerals such as gravel extraction, hard rock mining, the oil sector and geothermal energy.

What capital allowances are available when purchasing a property?

What is the Annual Investment Allowance (AIA)?

AIA allows businesses to claim 100% of qualifying expenditure on most plant and machinery up to a specified limit in the year of purchase. As of April 2023, the AIA limit is set permanently at £1 million annually. AIAs allow immediate tax relief unlike writing-down allowances which require the tax relief to be spread out over many years. Some assets (e.g. cars) do not qualify for AIAs. Related businesses have to share one amount of AIA.

What is Plant and Machinery?

While it’s generally straightforward to identify something as a machine, the definition of “plant” is much less clear. The key distinction lies between the equipment used to conduct business operations and the environment in which those operations take place.

In practice, plant and machinery cover a wide range of assets, from cars and computers to lifts, escalators, and even large machines. Some substantial assets, like grain stores, may also qualify as plant or machinery.

A major practical challenge is distinguishing between expenditure on plant and machinery and expenditure on buildings. This distinction can be difficult because significant portions of property costs, such as lighting and water systems, are classified as plant and machinery.

Capital allowances claims cannot be made until expenditures are accurately allocated to the appropriate categories. This process often involves ambiguity, particularly regarding what qualifies as “plant or machinery,” and has led to numerous court and tribunal cases

What are fixtures?

Accountants often use the term “fixtures and fittings” broadly, but for capital allowances purposes, the law provides a precise definition of “fixtures.”

In the context of capital allowances, fixtures are a specific type of plant and machinery. A fixture refers to an item of plant or machinery that is installed in or attached to a building or land in such a way that it becomes legally part of that property.

Thus, while all fixtures qualify as plant or machinery, not all plant or machinery are fixtures. For example, a car or laptop is considered plant but not a fixture, whereas a lift or radiator, once installed in a property, becomes both a fixture and plant or machinery. Although plant and machinery allowances are generally available for all these items, the rules governing fixtures are more complex.

What are integral features?

The term “integral features” refers to specific types of fixtures, making them a subset of “fixtures” and, by definition, part of plant or machinery.

“Integral features” has a precise legal definition. It includes systems such as heating (both space and water), ventilation, air cooling, and purification; floors and ceilings that are part of these systems; lighting and other electrical systems; cold water systems; lifts, escalators, moving walkways; and external solar shading.

Consider a hotel or care home: Tables, chairs, and beds are plant or machinery, and they qualify for plant and machinery allowances (PMAs), but they are neither fixtures nor integral features. Toilets, baths, and showers are plant and machinery as well as fixtures, but they are not integral features. The central heating system, including the boiler, pipework, and radiators, is classified as an integral feature, making it both a fixture and plant or machinery by definition.

What type of tax is affected by capital allowances?

Capital allowances primarily affect Corporation Tax for companies and Income Tax for sole traders, partnerships, and other unincorporated businesses. By claiming capital allowances, businesses can reduce their taxable profits, which in turn lowers the amount of Corporation Tax or Income Tax they need to pay. Here’s how it works:

- Corporation Tax: For companies, capital allowances reduce the taxable profits, leading to a lower Corporation Tax bill. The corporation tax rate is applied to the adjusted profit after deducting capital allowances.

- Income Tax: For sole traders, partnerships, and other unincorporated businesses, capital allowances similarly reduce the taxable profits, leading to a lower Income Tax liability. The reduced profit is taxed at the applicable Income Tax rates.

In both cases, capital allowances help to defer or reduce the tax payable by spreading the cost of capital investments over several years.

How is tax relief provided through capital allowances?

What are First-Year Allowances (FYAs)?

Similar to annual investment allowances, FYAs offer immediate tax relief, with the added benefit of no annual limit on the amount that can be claimed. However, FYAs are restricted to limited companies and specific expenditures.

Some assets qualify for a 100% deduction in the first year, which is typically used for energy-saving equipment or environmentally friendly investments. FYAs are typically available for zero-emission cars or vans, equipment for gas refuelling stations, and electric vehicle charging points. In a more restricted manner, FYAs are available—only to limited companies—for expenditure at designated freeport sites, investment zones (special tax sites), and under the “full expensing” rules whilst general and specific restrictions apply, for instance, relief for special tax sites is not available to property investors.

To be eligible for FYAs, the expenditure must be on new, unused assets and not on second-hand items. To be eligible for FYAs, the expenditure must be on new, unused assets and not second hand items.

What are Writing Down Allowances (WDAs)?

For costs exceeding the AIA limit or assets not qualifying for AIA, businesses can claim relief over time via WDAs at 18% (main pool) or 6% (special rate pool) per annum on a reducing balance basis.

The added value of a Capital Allowance Specialist

Without a specialist review, many businesses under-claim or miss out on Capital Allowances altogether, especially when acquiring, selling or refurbishing commercial property where embedded fixtures are involved.

At InnoFund, we:

Survey your property to identify hidden qualifying assets.

Prepare compliant claims in line with HMRC’s strict guidelines.

Maximise your relief, often identifying substantial tax savings over and above what standard accounting reviews uncover.

Capital Allowances for Property Investors and Developers

01

Purchase price allocation

02

Refurbishment and fit-out claims

03

Land remediation relief synergy

| Purchase price allocation | Refurbishment and fit-out claims | Land remediation relief synergy |

|---|---|---|

| Identifying qualifying plant and machinery within commercial property acquisitions. | Capturing relief on upgrades to integral features and fixtures. | Identifying where contaminated land and capital allowances overlap to deliver dual tax benefits. |