We identify more

What are Capital Allowances?

Capital allowances are tax deductions available to UK taxpayers for specific capital expenditures, such as machinery, equipment, and property improvements. By claiming these allowances, taxpayers can reduce their taxable profits, which in turn lowers their tax liability. There have been significant changes to CAs in recent years, including rates and eligibility criteria. Here’s everything you need to know if you’re considering making a capital allowances claim

Who Can Claim?

Capital allowances can be claimed by both property occupiers and investors whether as an individual or through an entity such as a partnership or a limited company. Commercial property includes care-homes, communal spaces in residential settings (such as student accommodation) and short-term furnished holiday lets such as Air BnB (although FHLs will cease to claim in April) 2025.)

How Do Capital Allowances Work?

Types of expenditure

Plant and Machinery

These assets are essential for running the business and are usually eligible for immediate or longer-term tax relief through PMAs. Qualifying items typically include:

-

Office equipment: Computers, desks, chairs, etc.

-

Vehicles: Vans, lorries, and cars (excluding certain low-emission vehicles).

-

Machinery: Manufacturing equipment, tools, and machinery used in production.

-

Fixtures and fittings: Shelving, air conditioning units, and security systems.

-

Large Structures: Such as grain stores can be plant or machinery.

Types of expenditure

Special Rate Items

Include assets with a longer useful life or those integral to a building’s function. These include:

-

Thermal insulation of buildings.

-

Electrical systems such as wiring.

-

Cold water systems.

-

Lifts, escalators, and moving walkways.

-

External solar shading.

Types of expenditure

Structures and buildings

-

Construction of new non-residential structures and buildings.

-

Renovation and conversion costs for commercial properties.

-

Costs of demolition or land alterations necessary for the construction.

Faqs

Statistics

Faqs

Frequently Asked Questions

What is capital expenditure?

Tax law distinguishes between two types of expenses:

Revenue Expenditure: These are routine costs necessary for the daily operation of a business, such as heating, lighting, employee salaries, and office supplies. These costs are immediately deducted from business profits when calculating taxable income.

Capital Expenditure: These are investments in assets that provide long-term benefits, typically over several years, such as purchasing buildings, vehicles, machinery, or computers. Unlike revenue expenditure, capital expenditure cannot be deducted directly from taxable profits. However, tax relief may be available through capital allowances. It is important to note that not all capital expenditures qualify for these allowances—for example, the cost of purchasing land typically does not qualify.

While revenue expenditures provide immediate tax relief, capital expenditures require a different approach for tax deductions.

What types of capital allowances are there?

The rules for all capital allowances are defined by legislation, most notably the Capital Allowances Act 2001. This Act, which is frequently updated, establishes distinct regimes with differing rules depending on the type of capital expenditure involved. The most common capital allowances are Plant or machinery, Certain commercial buildings and larger structures and Research and development. There are other allowances including:

Know-how Allowances: A relief available only for income tax (not corporation tax), for traders who incur qualifying expenditure on acquiring “know-how” (e.g., knowledge of industrial techniques or information).

Patent Allowances: Another relief for income tax only, applicable to traders who incur qualifying expenditure on acquiring “patent rights” (i.e., the right to perform actions that would otherwise infringe on a patent).

Mineral Extraction Allowances: Primarily for companies in the oil industry, but also applicable to businesses involved in extracting minerals such as gravel or sand.

Dredging Allowances: Available to individuals or businesses engaged in a qualifying trade who incur qualifying expenditure on dredging. The definition of “qualifying trade” is broad, encompassing activities such as navigation maintenance, fishing, manufacturing, processing, and storage.

Obsolete Capital Allowances: The tax rules change frequently, and some capital allowances are no longer available. These include industrial buildings allowances, agricultural buildings allowances, business premises renovation allowances, assured tenancy allowances, and flat conversion allowances.

InnoFund’s experts can take a holistic view of your whole business to ensure tax savings are maximised with full HMRC compliance.

What are embedded capital allowances (or embedded fixtures and features)?

At InnoFund we avoid the terms “embedded fixtures and features” or “embedded capital allowances,” when discussing property because they lack legal definitions and can lead to confusion.

Some people use “embedded fixtures” to refer to any fixtures, while others use it specifically to mean integral features.

In practice, both “fixtures” and “integral features” have clear legal definitions. It is more accurate and less confusing to use these correct terms rather than relying on vague expressions like “embedded fixtures,” which do not have precise meanings.

What capital allowances are available when purchasing a property?

The percentage of expenditure that qualifies for capital allowances when purchasing a property varies based on the type of property and other factors, but it can be as much as 40% or more of the property’s cost. Acquiring commercial properties such as an office building, restaurant or hotel can have a significant portion of the cost qualifying as plant or machinery and PMA apply to the fixtures (including integral features) within the property.

For example, if an office is purchased for £1,000,000.00 up to £400,000 might qualify as fixtures, enabling the buyer to claim PMAs. This could result in tax savings of up to £180,000.

Additionally, capital allowances may be available for any non-fixtures included in the purchase.

Capital allowances cannot be claimed twice, so the buyer and seller must agree on how to allocate the available tax relief for the fixtures (and any other plant or machinery). This is a critical negotiation point, and obtaining expert advice early in the process can significantly benefit the party involved. There are specific legal requirements to secure the tax relief, and failure to properly address these can result in the permanent loss of the capital allowances tax savings for both parties.

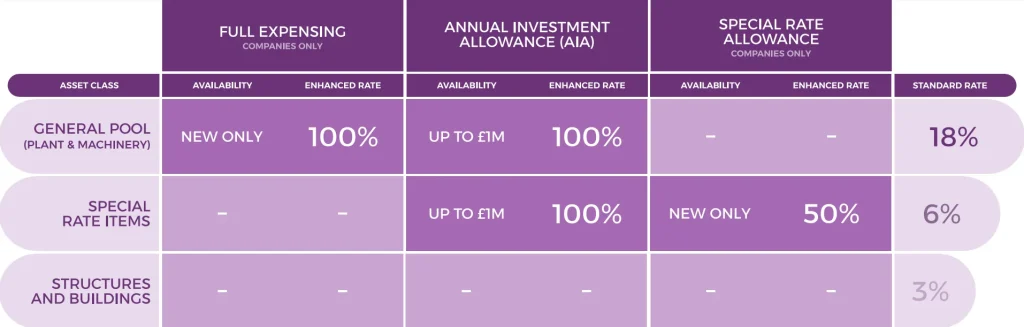

What are Annual Investment Allowances (AIA)?

Businesses can claim 100% of the cost of qualifying plant and machinery (up to £1m annually) in the year the expenditure is incurred. AIAs allow immediate tax relief unlike writing-down allowances which require the tax relief to be spread out over many years. Some assets (e.g. cars) do not qualify for AIAs. Related businesses have to share one amount of AIA.

What is Plant and Machinery?

While it’s generally straightforward to identify something as a machine, the definition of “plant” is much less clear. The key distinction lies between the equipment used to conduct business operations and the environment in which those operations take place.

In practice, plant and machinery cover a wide range of assets, from cars and computers to lifts, escalators, and even large machines. Some substantial assets, like grain stores, may also qualify as plant or machinery.

A major practical challenge is distinguishing between expenditure on plant and machinery and expenditure on buildings. This distinction can be difficult because significant portions of property costs, such as lighting and water systems, are classified as plant and machinery.

Capital allowances claims cannot be made until expenditures are accurately allocated to the appropriate categories. This process often involves ambiguity, particularly regarding what qualifies as “plant or machinery,” and has led to numerous court and tribunal cases over more than a century.

What are fixtures?

Accountants often use the term “fixtures and fittings” broadly, but for capital allowances purposes, the law provides a precise definition of “fixtures.”

In the context of capital allowances, fixtures are a specific type of plant and machinery. A fixture refers to an item of plant or machinery that is installed in or attached to a building or land in such a way that it becomes legally part of that property.

Thus, while all fixtures qualify as plant or machinery, not all plant or machinery are fixtures. For example, a car or laptop is considered plant but not a fixture, whereas a lift or radiator, once installed in a property, becomes both a fixture and plant or machinery. Although plant and machinery allowances are generally available for all these items, the rules governing fixtures are more complex.

What are integral features?

The term “integral features” refers to specific types of fixtures, making them a subset of “fixtures” and, by definition, part of plant or machinery.

“Integral features” has a precise legal definition. It includes systems such as heating (both space and water), ventilation, air cooling, and purification; floors and ceilings that are part of these systems; lighting and other electrical systems; cold water systems; lifts, escalators, moving walkways; and external solar shading.

Consider a hotel or care home:

Tables, chairs, and beds are plant or machinery, and they qualify for plant and machinery allowances (PMAs), but they are neither fixtures nor integral features.

Toilets, baths, and showers are plant and machinery as well as fixtures, but they are not integral features.

The central heating system, including the boiler, pipework, and radiators, is classified as an integral feature, making it both a fixture and plant or machinery by definition.

The distinction between integral features and other fixtures

What type of tax is affected by capital allowances?

Capital allowances primarily affect Corporation Tax for companies and Income Tax for sole traders, partnerships, and other unincorporated businesses. By claiming capital allowances, businesses can reduce their taxable profits, which in turn lowers the amount of Corporation Tax or Income Tax they need to pay.

Here’s how it works:

1. Corporation Tax: For companies, capital allowances reduce the taxable profits, leading to a lower Corporation Tax bill. The corporation tax rate is applied to the adjusted profit after deducting capital allowances.

2. Income Tax: For sole traders, partnerships, and other unincorporated businesses, capital allowances similarly reduce the taxable profits, leading to a lower Income Tax liability. The reduced profit is taxed at the applicable Income Tax rates.

In both cases, capital allowances help to defer or reduce the tax payable by spreading the cost of capital investments over several years.

How is tax relief provided through capital allowances?

Tax relief for capital allowances is provided by allowing businesses to deduct the cost of certain capital expenditures from their taxable profits. This reduces the overall tax liability of the business. The method of giving tax relief is different for individual types of capital allowances. For plant and machinery allowances, relief may be given by way of annual investment allowances, first-year allowances, writing-down allowances, or sometimes balancing allowances.

What are First-Year Allowances (FYAs)?

Similar to annual investment allowances, FYAs offer immediate tax relief, with the added benefit of no annual limit on the amount that can be claimed. However, FYAs are restricted to limited companies and specific expenditures.

Some assets qualify for a 100% deduction in the first year, which is typically used for energy-saving equipment or environmentally friendly investments. FYAs are typically available for zero-emission cars or vans, equipment for gas refuelling stations, and electric vehicle charging points.

In a more restricted manner, FYAs are available—only to limited companies—for expenditure at designated freeport sites, investment zones (special tax sites), and under the “full expensing” rules whilst general and specific restrictions apply, for instance, relief for special tax sites is not available to property investors.

To be eligible for FYAs, the expenditure must be on new, unused assets and not on second-hand items. To be eligible for FYAs, the expenditure must be on new, unused assets and not on second-hand items. To be eligible for FYAs, the expenditure must be on new, unused assets and not on second-hand items.

What are writing-down allowances (WDAs)?

Writing-down allowances (WDAs) are given when AIAs or FYAs are not available for the cost (or full cost) of the plant or machinery if the cost of the asset exceeds the AIA limit or the asset doesn’t qualify for AIA or FYA, the business can still claim a portion of the asset’s value each year using WDAs. The standard WDA rates are:

• Main pool: 18% of the remaining value of the assets.

• Special rate pool: 6% for assets like integral features (e.g., electrical systems, heating systems) and long-life assets.

In practice, most assets are merged together (“pooled”), and the pool grows as new assets are added, and reduces as allowances are given or as disposal proceeds are received.

We identify more

Capital Allowance Specialists

We can reduce your tax liabilities and recover outstanding tax paid against commercial property that you have spent capital buying and/or improving.

Our property team will determine your eligibility to claim and deal with all aspects of the claim from start to finish including any post filing HMRC support.

Underclaimed, overlooked and often lost forever

Why are capital allowances typically underclaimed?

Accountants typically deal with information they are given, whilst many costs will remain hidden as non-invoiced expenditure such as Property Embedded Fixtures and Fixings (PEFFs) these can often be overlooked.

InnoFund employ a multi-disciplinary approach with a team of surveyors, tax specialists and property lawyers which is head by our Head of Capital Allowances Mak. We utilise a multi-faceted approach to ensure no stone is left unturned, maximsing tax benefits for our clients with full HMRC compliance.

Accountants typically deal with information they are given, whilst many costs will remain hidden as non-invoiced expenditure such as Property Embedded Fixtures and Fixings (PEFFs) these can often be overlooked.

InnoFund employ a multi-disciplinary approach with a team of surveyors, tax specialists and property lawyers which is head by our Head of Capital Allowances Mak. We utilise a multi-faceted approach to ensure no stone is left unturned, maximsing tax benefits for our clients with full HMRC compliance.