R&D Tax for Engineering

The engineering sector plays a vital role in the UK economy, employing around 5.7 million people, which represents over 19% of the total workforce and is estimated to contribute approximately £500 billion annually to the UK’s GDP. Given the sector’s substantial economic impact, it is surprising that only £525 million is claimed in R&D tax relief, accounting for just 2% of the total value of R&D tax credit claims.

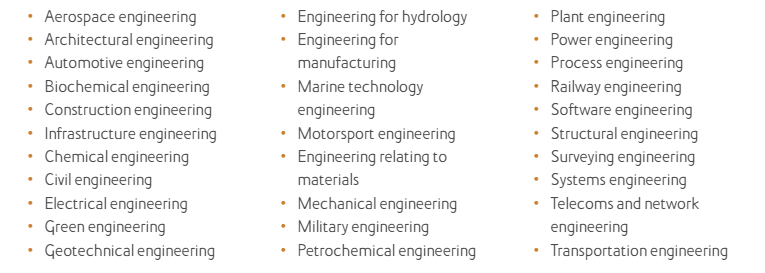

Can my engineering businesses qualify?

- Aerospace Engineering

- Architectural Engineering

- Automotive Engineering

- Biochemical Engineering

- Construction Engineering

- Infastructure Engineering

- Chemical Engineering

- Civil Engineering

- Electrical Engineering

- Green Engineering

- Geotechnical Engineering

- Engineering for hydrology

- Engineering for Manufacturing

- Marine Technology Engineering

- Motorsport Engineering

- Engineering relating to materials

- Mechanical Engineering

- Military Engineering

- Petrochemical Engineering

- Plant Engineering

- Power Engineering

- Process Engineering

- Railway Engineering

- Software Engineering

- Structural Engineering

- Surveying Engineering

- Systems Engineering

- Telecoms and Network Engineering

- Transportation Engineering

Examples of Qualifying Engineering Activities for R&D Tax Relief

with improved performance, functionality, or efficiency.

Enhancing existing manufacturing processes to increase efficiency, reduce waste, or improve quality.

Developing new materials with improved properties, such as strength, durability, or weight reduction Experimenting with alternative materials to enhance product performance or reduce costs.

Developing algorithms or control systems to improve automation and process efficiency.

• Designing and implementing systems to reduce energy consumption or emissions.

• Developing renewable energy technologies or improving existing ones.

• Innovating to meet new regulatory requirements or safety standards.

• Developing systems to improve workplace safety or product compliance.

• Scaling up prototypes to full production while overcoming technical hurdles.

• Conducting extensive testing to ensure that new designs meet performance criteria.

• Integrating advanced technologies, such as AI, IoT, or robotics, into existing processes or products.

• Developing new methods for integrating complex systems and ensuring their interoperability.

Subsidised/ Subcontracted R&D

Many engineering firms incorrectly claim under the SME scheme when the final deliverable is to a client. If the R&D work formed part of the contract with your client, it’s likely that this activity will be funded directly or subcontracted by a third party, which would mean the project would have to be treated under the large company scheme (old RDEC scheme). This is a complicated area of the legislation to apply and it has resulted in a number of tribunal cases to test how the rules should be applied.

For accounting periods beginning on or after the 1st of April 2024 the new merged scheme (RDEC) will come into play and architecture clients will be prevented in claiming work that is subcontracted to them. Partnering with InnoFund early allows companies to utilise SecureRD™, InnoFund’s proprietary solution is the safest way to protect your future R&D claims, amongst many other benefits, clients can utilise InnoFund’s expertise on how to set up contracts with us reviewing your work to ensure your future R&D claims are secured.

How We’ll Support You

Our R&D Tax teams specialises in all engineering sector claims, we employ PhD engineers, Sector specialists and ex-HMRC inspectors to run through your projects with a fine-tooth comb leaving no stone unturned whilst maximising HMRC compliance. We manage your claim proactively, minimising your time investment so that you can focus on core business with the following in scope:

- Identify the appropriate scheme for your business.

- Conduct a comprehensive review of your R&D activity to maximise your claim.

- InnoFund take the burden of report writing to free up your time

- Prepare a claim that minimises potential HMRC queries.

- Unrivalled HMRC dispute resolution headed by the UKs leading R&D Tax compliance expert with accredited mediators in the event of HMRC enquiries

Safeguard Your R&D Tax with InnoFund

Partnering with InnoFund gives companies a unique opportunity to utilise SecuRD®, our proprietary solution which we believe is the safest way to claim R&D Tax. We add value to clients by leveraging InnoFund’s expertise in both R&D lifecycle management and R&D Tax Credits, act today to maximise the success of your future R&D claims from services such as:

01

Analysing previous R&D and benchmarking it against the baseline of your industry

02

R&D lifecycle management consulting and R&D road mapping to increase your chances of innovation and the size and security of R&D claims in the future

03

Safeguard future R&D relief by strategically reviewing your current operations to maximize benefits under available R&D funding options.

04

Visualise the value of a future tax benefit with upcoming R&D projects and allow commercial teams to tender for work more competitively

Value Added - Beyond R&D Tax

SecureRD™ is the only solution in the UK of it’s kind, as we look to safeguard future opportunities we also can predict future tax benefits, this approach means that our clients can budget more accurately when predicting future tax benefits allowing our construction clients’ to win more business as they can tender work more competitively when considering the true cost of a project with R&D benefits in mind.

Engineering businesses should explore all R&D incentives, from tax credits and grants for upfront design and product development work to Research and Development Allowances (RDA) for capital spend on prototype structures, and patent box for sales or licensing of protected technology. We also help identify other sources of R&D support and plan your R&D strategy, considering available incentives and grants. Our holistic approach ensures continuous support throughout the business lifecycle, not just during the claim preparation