Patent Box 101

Reduce your corporation tax to 10% with InnoFund

At InnoFund, we help businesses like yours turn intellectual property into real financial advantage.If you own or have exclusive rights to a qualifying patent, you could significantly reduce your corporation tax bill through the UK’s Patent Box regime.

Simba Mareverwa

Head of Compliance & Tax Disputes

- 20+ Years in Corporation Tax compliance, previously head of HMRC disputes at UK’s largest R&D Taxfirm

- Defended the most R&D Tax claims in enquiry by volume in the UK

- Has worked on Patent Box claims and HMRC enquiries into Patent Box since the schemes inception in 2013.

What is the Patent Box?

The Patent Box is a government incentive designed to encourage companies to retain and commercialise patents in the UK. Under the scheme, profits earned from patented inventions are taxed at a reduced corporation tax rate of 10% – compared to the standard 25% rate. By taking advantage of Patent Box, you can reinvest those tax savings directly back into innovation and growth

What patents are eligible for Patent Box?

What income qualifies?

- Sales of patented products or products incorporating a patented component

- Licensing or royalty fees for patented technology

- Sales of patented processes or services using patented inventions

- Compensation from infringement proceedings/insurance

Who can benefit?

There are a number of qualifying criteria your business must meet in order to claim relief,

including:

- Liable to corporation tax

- Making profits from the patent

- Having an exclusive licence for, or owning, the patent

- As part of a group company that meets the active ownership condition

- Meeting the qualifying development condition

Missing an opportunity?

InnoFund can identify patents or even design new patents through InnoGuard®

– Fixed Price

– 100% success rate

– Quicker turnaround

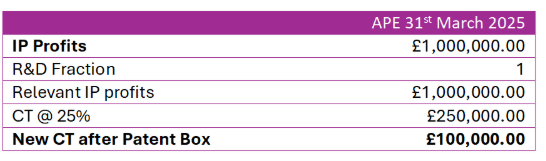

How much can you save?

The Patent Box is a government incentive designed to encourage companies to retain and commercialise patents in the UK. Under the scheme, profits earned from patented inventions are taxed at a reduced corporation tax rate of 10% – compared to the standard 25% rate. By taking advantage of Patent Box, you can reinvest those tax savings directly back into innovation and growth

Calculating the Nexus R&D Fraction

Since 1 July 2021, all Patent Box claims must demonstrate a clear connection between qualifying R&D activities and the patented innovation. This is done by calculating an R&D fraction for each relevant patent or patented process, applied to the associated income streams.

The purpose of this requirement is to ensure that only companies that can prove a direct link – or nexus – between their R&D efforts and the resulting tax benefit can access the reduced Patent Box tax rate.

The R&D fraction is a figure between 0 and 1. It starts at 1 but may be reduced if the company has incurred costs to acquire the patent (e.g., purchasing IP rights) or has outsourced R&D to connected parties such as group companies or related subcontractors.

How does Patent Box work?

a qualifying patent granted by the UK Intellectual Property Office (IPO), European Patent Office (EPO) or certain other jurisdictions.

the patented innovation or have played a significant role in its creation.

into Patent Box within two years of the end of the relevant accounting period.

How InnoFund can help

At InnoFund, we take the complexity out of Patent Box claims. Our team of tax and IP

specialists work alongside your business so that you access the full benefit of Patent Box

without the headache by:

- Identifying eligible patents and income streams

- Maximising the value of your claim with full HMRC compliance.

- Navigate the necessary calculations and documentation.

- Handle the election process and liaise with HMRC

We make sure you access the full benefit of Patent Box without all the headache.

Patent Box and R&D Tax Relief

Did you know you can claim both R&D tax relief and Patent Box? Many companies are eligible for both incentives, increasing the overall tax savings on innovation projects. InnoFund takes a holistic view on your innovation, together we build a strategy that combines both schemes to maximise your return.

Frequently Asked Questions

Can we claim if we don’t manufacture products ourselves?

What if we share the IP with another company – can we still claim?

Am I still eligible for Patent Box with a patent I have licenced?

What is an exclusive licence?

An exclusive licence is a legal agreement where the patent holder grants another party the exclusive rights to exploit the IP, instead of doing so themselves. This typically includes:

- The right to one or more key patent rights, excluding all others, within specific

countries or territories. - The right to pursue legal action for infringement independently and to retain all, or

most, of any damages awarded.

In simple terms, it is a formal agreement between the IP owner and the licensee, granting the licensee exclusive rights to use the IP without risk of infringement.

How InnoFund can help

At InnoFund, we take the complexity out of Patent Box claims. Our team of tax and IP specialists work alongside your business so that you access the full benefit of Patent Box without the headache by:

- Identifying eligible patents and income streams

- Maximising the value of your claim with full HMRC compliance

- Navigate the necessary calculations and documentation

- Handle the election process and liaise with HMRC

We make sure you access the full benefit of Patent Box without all the headache